The Greek financial crisis was a series of debt crises that began with the global financial crisis of 2008. Its source originated in the mismanagement of the Greek economy and of government finances, however, rather than exogenous international factors. To compound the problems, Greece’s membership in the Eurozone prevented it from exercising full control over its monetary policy, so interest rates were kept too low for too long relative to the inflationary pressures that were building up in the Greek economy. Despite Greece being beset by economic mismanagement and misreporting of economic performance by successive governments, investors failed to pick up on or act on a growing collection of warning signs.

The Greek Financial Crisis (2009–2016)

Timeline

Greece’s adhesion to Europe and the euro

- 1961: Greece is accepted by the six-member EEC (European Economic Community), the precursor of the European Union, as its first associate member, with the aim of Greece joining the EU before 1984.

- 1 January 1981: Greece joins the EEC (EU).

- 1992: The Maastricht Treaty is signed, paving the way for unrestricted movement of goods and people within the European Union and the future establishment of a single currency, the euro.

- 1 January 1999: Greece fails to qualify for inclusion in the single currency arrangement in the first batch of countries requesting to join.

- 1 January 2001: Greece is admitted to the Eurozone and plans to adopt the euro.

- 1 January 2002: The euro is launched with the first banknotes and coins circulating in 11 EU countries.

Greece in the run-up to the crisis

- November 2004: Eurostat notes that the Greek budget deficit and government debt have been misreported on no less than 11 occasions since 2000.

- 2005–2009: Eurostat issues concerns about the quality of Greek data on five separate occasions.

Greece in crisis

- September 2008: Lehman Brothers collapses, marking the start of the global financial crisis.

- October 2009: The newly elected Greek government revises its forecast for the 2009 budget deficit to a startling 12.5% of GDP, up from an earlier estimate of 3.7% of GDP.

- December 2009: Three renowned credit-rating agencies downgrade Greece’s credit ratings. Fitch downgrades Greek debt to below A for the first time in a decade.

- Early 2010: The Greek government introduces its first austerity measures. The yield on Greek government debt soars.

- April 2010: Credit-rating agencies further downgrade Greek debt. Standard & Poor’s downgrades it to junk bond status, threatening a sovereign default.

- May 2010: Greece receives its first bailout from the troika, EUR110 billion.

- 2011: Greece’s creditors agree to take a haircut on their debt of 53.5% of face value.

- February 2012: A second Greek bailout, EUR 130 billion, takes place.

Greek attempts to emerge from crisis

- January 2014: Greece announces it attained a primary budget surplus (excluding interest payments) in 2013.

- April 2014: Greece returns to the capital markets for funding for the first time in four years.

- May 2014: Fitch upgrades Greece’s credit rating to B from B–.

- January 2015: A snap general election leads to victory of the far-left Syriza Party, an anti-austerity party hostile to bailouts and international creditors. In power, Syriza introduces a financial package to alleviate poverty and the effects of previous austerity measures.

- June 2015: Greece defaults on a USD1.7 billion IMF payment, making it the first developed country to ever default on an IMF loan and the first country to default since Zimbabwe in 2001.

- 5 July 2015: In a referendum held on Greece’s third bailout package, the Greek people reject its terms by 61.3% to 38.7%. Nonetheless, the government pushes ahead with the austerity measures required by the bailout.

Investment Principles

Principle #1

Investors should exercise prudence—in some cases, extreme caution—before assuming government-compiled statistics are reliable and can be used as a basis for their investment decisions.

Principle #2

Political calculus may override obviously beneficial economic decision-making by governments, resulting in chronic suboptimal outcomes.

Principle #3

Governments may make decisions that are incoherent and inconsistent with previous policies or their future goals.

Principle #4

Investors should vigilantly maintain an independent view of world events, as the crowd can sometimes lead one off a cliff.

What do you think about these principles?

See what others are saying.

Write a Comment

Sources

De Santis, Roberto A. 2012. “The Euro Area Sovereign Debt Crisis,” European Central Bank Working Paper No. 1419 (February): https://www.ecb.europa.eu/pub/pdf/scpwps/ecbwp1419.pdf.

Ellyatt, Holly. 2016. “Why Greece’s Economic Crisis is Not Over,” CNBC (August): http://www.cnbc.com/2016/08/22/nobody-believes-in-anything-anymore-why-greeces-economic-crisis-is-not-over.html.

European Commission. 2010. Eurostat Report on Greek Government Deficit and Debt Statistics (January): http://ec.europa.eu/eurostat/documents/4187653/6404656/COM_2010_report_greek/c8523cfa-d3c1-4954-8ea1-64bb11e59b3a.

European Commission. 2011. “Restructuring of the Greek Railway Group TRAINOSE S.A2012..” (13 July): http://ec.europa.eu/competition/state_aid/cases/241369/241369_1260391_65_2.pdf.

Eurostat. 2004. “Report on the Revision of the Greek Government Deficit and Debt Figures” (22 November): http://ec.europa.eu/eurostat/documents/4187653/5765001/GREECE-EN.PDF/2da4e4f6-f9f2-4848-b1a9-cb229fcabae3?version=1.0.

“OECD Explaining Greece’s Debt Crisis.” 2016. New York Times (June): http://www.nytimes.com/interactive/2016/business/international/greece-debt-crisis-euro.html?_r=0.

Fernando, Vincent, CFA, and Kamelia Angelova. 2010, Discussion of Greek bond yields, Business Insider (April): http://www.businessinsider.com/chart-of-the-day-greeces-2-year-vs-10-year-yields-2010-4?international=true&r=US&IR=T.

Hellenic Republic Ministry of Economy and Finance. 2006. “Stability and Convergence Programme, Greece 2006–2007” (December): http://ec.europa.eu/economy_finance/economic_governance/sgp/pdf/20_scps/2006-07/01_programme/2006-12-18_el_sp_en.pdf.

Huneke, Samuel Clowes. “The Accumulation of Greek Debt,” Seven Pillars Institute: http://sevenpillarsinstitute.org/case-studies/1492-2.

Kashyap, Anil. 2015. “A Primer on the Greek Crisis,” University of Chicago, Booth School of Business (July): http://faculty.chicagobooth.edu/anil.kashyap/research/papers/A-Primer-on-the-Greek-Crisis_june29.pdf.

Markose, Sheri. 2015 “A Tragedy in Three Parts: How the Greek Debt Crisis Unfolded,” University of Essex (July): http://theconversation.com/a-tragedy-in-three-parts-how-the-greek-debt-crisis-unfolded-44680.

Nelson, Rebecca, Paul Belkin, and Derek Mix. 2011. “Greece’s Debt Crisis: Overview, Policy, Responses, and Implications,” Congressional Research Service (18 August): https://fas.org/sgp/crs/row/R41167.pdf.

OECD. 2009. “Greece at a Glance: Policies for a Sustainable Recovery” https://www.oecd.org/greece/44785912.pdf.

OECD. 2016. “Greek Economic Survey” (March): http://www.keepeek.com/Digital-Asset-Management/oecd/economics/oecd-economic-surveys-greece-2016_eco_surveys-grc-2016-en#page1.

Philips, Matthew. 2015. “History of the Greek Debt Crisis,” Quartz (June): http://qz.com/440058/the-complete-history-of-the-greek-debt-drama-in-charts/.

Singh, Kavaljit (director of Madhyam, a policy research institute in India). 2015. “A Simple Guide to the Unfolding Financial Drama in Greece” (July): http://thewire.in/5346/restructuring-greeces-debt/.

Smith, Helena. 2016. “A Year after the Crisis Was Declared Over, Greece Is Still Spiraling Down,” Guardian (August): https://www.theguardian.com/business/2016/aug/13/greek-economy-still-spiralling-down-year-after-crisis-declared-over.

“Who’s Exposed to Greece?” 2010. FT Alphaville (April): https://ftalphaville.ft.com/2010/04/28/214521/whos-exposed-to-greece/.

Various data series on the Greek economy:

Bank of Greece: http://www.bankofgreece.gr/Pages/en/Statistics/default.aspx

Hellenic Statistical Authority: http://www.statistics.gr/en/home/

International Monetary Fund: http://www.imf.org/external/ns/search.aspx?NewQuery=Greece&submit=&submit.

Analysis and Commentary

The Greek financial crisis was a series of debt crises that started with the global financial crisis of 2008. Its causes were largely endogenous in nature, however, because its source originated in mismanagement of the Greek economy and of government finances rather than exogenous international factors. Furthermore, Greece’s membership in the Eurozone prevented it from exercising full control over its monetary policy, which meant that interest rates were kept too low for too long relative to the inflationary pressures that were building up in the Greek economy. Monetary policy was out of sync with a booming economy and easy access to credit.

The Greek financial crisis had two primary causes. First, Greece was undermined by government economic mismanagement, including widespread fraud and an absence of public accountability. Second, Greece’s membership in the Eurozone imposed on it an economic straitjacket that was ill suited to and inconsistent with its political and financial goals.

Despite Greece being beset by economic mismanagement and misreporting of economic performance by successive governments, investors failed to pick up or act on a growing collection of warning signs:

In addition, the lack of accountability and proper oversight in so many aspects of Greek public finances compounded the problems. At the height of the global financial crisis in the closing months of 2009, however, investors’ minds were distracted by the banking crisis in the rest of the world, so the spotlight was not fully focused on the specific issues in Greece.

The Eurozone, established for political purposes as a next step on the path to closer economic and monetary union within the European Union, gave rise to a flawed economic structure, and Greece’s inclusion in the Eurozone made Greece’s crisis inevitable.

From the late 1990s onward, Greece’s impending membership in the Eurozone encouraged investors to play a convergence game—buying up large amounts of Greek government debt and driving interest rates down as spreads tightened relative to core Eurozone countries. Low interest rates fueled an economic boom, which was sustained also by large inflows of foreign direct investment. The private-sector credit bubble that emerged was one symptom of unsustainable growth. Yet, in the years leading up to the global financial crisis, the Greek government itself chose to binge on increased spending, bringing about a significant increase in the budget deficit and overall government debt levels.

As Greece’s fiscal deficits surged in 2008–2010, interest rates on government and private debt in Greece shot up significantly. Handcuffed by the European Central Bank (ECB), however, Greece was unable to reduce interest rates or devalue its currency to stimulate economic growth. Greece was, in short, unable to implement its own monetary policy to match its fiscal and political needs.

Three bailouts, totaling EUR246 billion, coupled with draconian austerity measures, partially stabilized the situation but at a tremendous human cost in terms of generating chronically high unemployment, widespread poverty, and plummeting incomes. Real GDP contracted by approximately one-fourth between 2009 and 2015.

Investors allowed the strong economic upswing and convergence of the Greek economy with its Eurozone partners to distract them from closer scrutiny of Greece’s fundamental financial and economic problems. Smart investors would have learned not to take government statistics or public pronouncements at face value; smart investors do their own research and trust their own instincts about a situation.

Greece’s Membership in the Eurozone Contributes to the Crisis

Many of the woes in Greece’s financial crisis stemmed from its membership in the Eurozone. The Eurozone was created in 1999 as a monetary union among 11 countries (of the, then, 15 member states of the European Union) that lacked corresponding fiscal and political unions. Greece had not qualified to join the Eurozone in 1999 when the initial list of candidate entrants was drawn up, because it failed to meet the 1992 Maastricht Treaty economic requirements for countries joining the zone. Under the terms of the EU Stability and Growth Pact, established in 1996, the economies of new members had to converge with Eurozone members to a certain degree. Convergence was demonstrated by compliance with five criteria, including: low inflation, a budget deficit of less than 3% of GDP, and government debt levels of less than 60% of GDP.

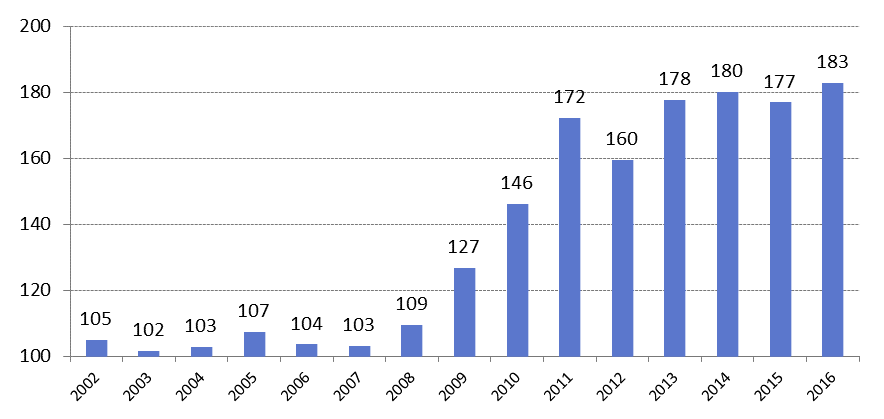

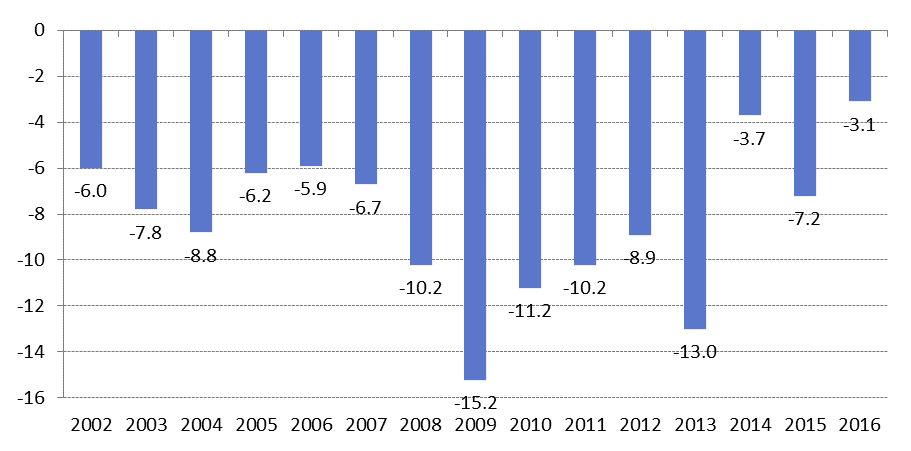

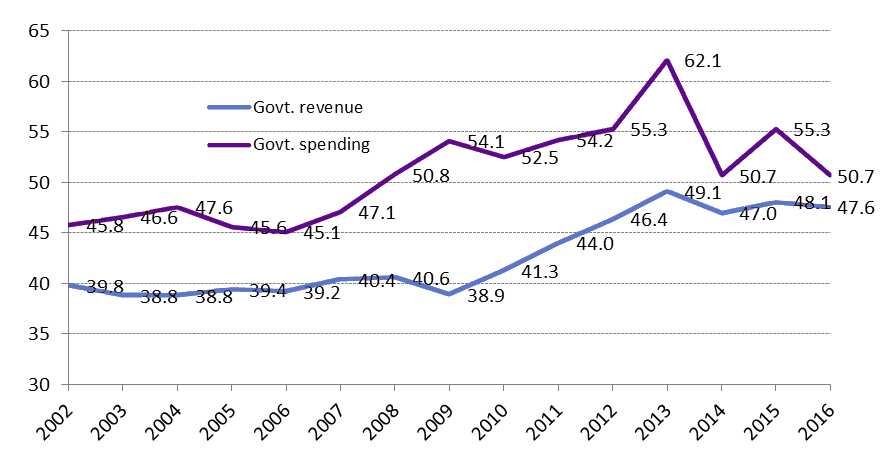

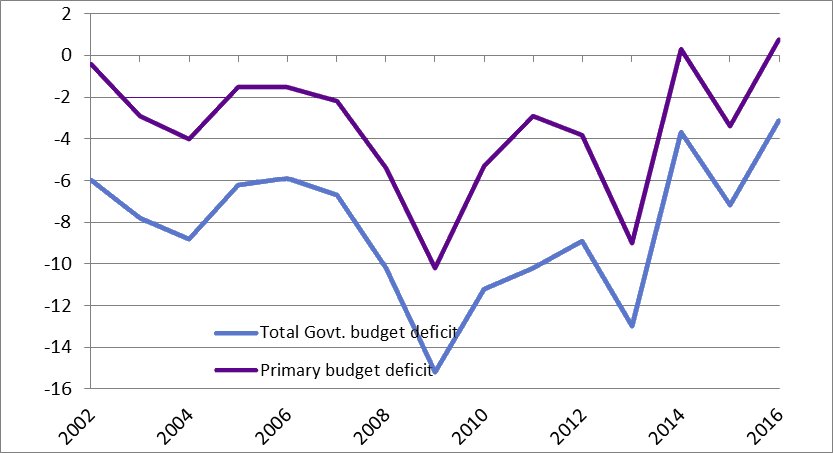

Greece was allowed to belatedly join the Eurozone in early 2001 as its 12th member despite having a budget deficit well in excess of 3% of GDP and government debt in excess of 100% of GDP. Exhibit 1 shows Greece’s gross government debt as a percentage of GDP from 2002 through 2016. Exhibit 2 shows the Greek government budget deficit as a percentage of GDP for the same years.

Exhibit 1: Greek Gross Government Debt as a Percentage of GDP, 2002–2016

Source: European Commission, Eurostat.

Exhibit 2: Greek Government Budget Deficit as a Percentage of GDP, 2002–2016

Source: European Commission, Eurostat.

Allowing Greece to join the Eurozone in these circumstances was obvious political rule bending, and it undermined the credibility of the European project. Instead of strictly observing its own rules for membership, the EU chose to grant Greece membership. Greece had always been enthusiastic about joining at the earliest opportunity, irrespective of its degree of readiness.

Membership in the Eurozone was a major economic constraint on Greece. If Greece had not agreed to the single currency, it could have devalued its currency to stimulate exports and its economy and inflate its way out of the crisis. Currency devaluation would have taken the pressure off interest rates. Greece could not set its own interest rates, however, because for a member of the Eurozone, the role of determining interest rates is assumed by the ECB. Naturally, the ECB’s aim is to maintain stability of the euro and the Eurozone economies and to keep inflation under control. It has no direct mandate concerning Greece or any individual Eurozone economy in particular. Therein lay the problem.

When the crisis unfolded in 2010 with large budget deficits and debt maturities to be refinanced with more bond issuance, Greek bond yields soared. Investors were unwilling to grant such a blank check to Greece without a substantially improved reward for holding this risky debt. Greece’s membership in the single currency acted as a lock on the system. Greece found itself without an adjustment mechanism that could have partly alleviated the impact of the crisis. Greece paid the price of this lack of control of its monetary policy in terms of a severe contraction in GDP and living standards.

As a result of the deepening crisis, talk arose of Greece leaving the Eurozone. However, a Greece operating with its own currency outside the Eurozone would have faced other challenges. First, the EU would most likely not have felt required to intervene in Greece’s crisis and would have been more inclined to let the country fend for itself. No massive bailouts of Greek debt would have come from the zone.

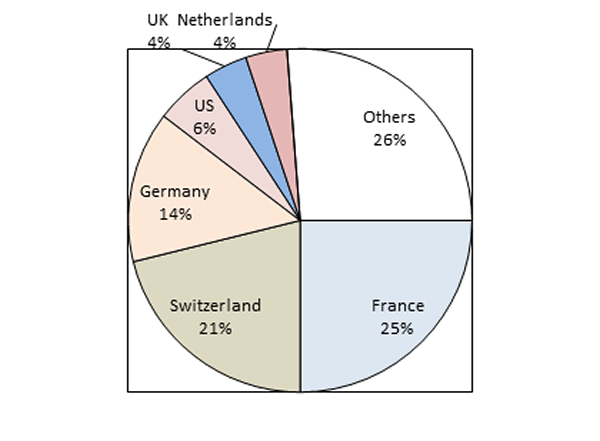

Other Eurozone governments were eager to bail out Greece in part because their banks were so involved in lending to Greece. They had an interest in keeping Greece afloat to keep a Greek default from destabilizing the financial systems of their own countries. Exhibit 3 highlights just how implicated European banks were in the Greek financial system.

Exhibit 3: Share of Greek Sovereign Debt Held by Foreign Banks by Nationality, 2010

Source: Bank for International Settlements, April 2010.

Second, if Greece had reintroduced its own currency, it would have needed a significant degree of devaluation to compensate investors for the risk of holding the currency, especially (as discussed later) given its track record of misleading investors with misreported economic and financial data. Significant currency devaluation usually results in higher inflation, effectively amounting to a real wealth transfer from creditors to debtors.

Third, devaluation of the newly-introduced local currency relative to the euro would have compounded the problem by increasing the amount of debt in the introduced local currency. An exit from the Eurozone was likely to provide only some short-term relief before long-term problems set in.

Greece has a long tradition of seeing itself as a member of a political Europe, which rendered the option of a departure from the Eurozone not just unpalatable but distinctly unlikely. Despite the negative effects of the crisis, Greek public opinion was largely in favor of remaining in the Eurozone. One opinion poll conducted in June 2015 by GPO showed that 70% supported remaining in the Eurozone at any cost, a remarkable position in light of the painful adjustment the country was going through.

That Greece was able to join the EU’s single currency area despite not qualifying in terms of the 1992 Maastricht Treaty was a personal triumph for Greek politicians. Hence, it is understandable that the Greek political class was so ideologically wedded to Europe and the euro as a currency. The extent of Greece’s commitment to Europe can be judged by the country’s abandonment of a 2,500-year-old currency, the drachma, in favor of the euro, which existed only when notes and coins were introduced across Eurozone countries in January 2002. To reintroduce its own currency would have been seen as isolationist and inward looking. Greece needed Europe and was not prepared to leave the Eurozone, even if that meant externally imposed constraints and a severe austerity cure. Currency, therefore, could not play a part in the economic adjustment Greece had to undergo.

Investors Bet on Convergence before Greece Joins the Eurozone

Even before joining the Eurozone in 2001, investors were betting that Greece would converge with the core Eurozone countries, which had far lower interest rates than Greece. Lower interest rates in core Eurozone countries reflected sustained, low inflation and reasonably balanced budgets, which provided a platform for additional financial stability and promoted economic growth. One of the benefits of joining the Eurozone was purported to be an almost certain degree of convergence in terms of economic criteria, including living standards, economic integration and cooperation.

EU authorities expected a certain degree of convergence to have taken place before a country joined in order for it not to destabilize the euro. In addition, investors expected further convergence to take place between peripheral Eurozone countries (Portugal, Greece, Italy, Spain, Ireland) and the core Eurozone countries (Germany, France, Benelux). This investment tactic was supported by the official convergence criteria that countries were supposed to meet to join the Eurozone.

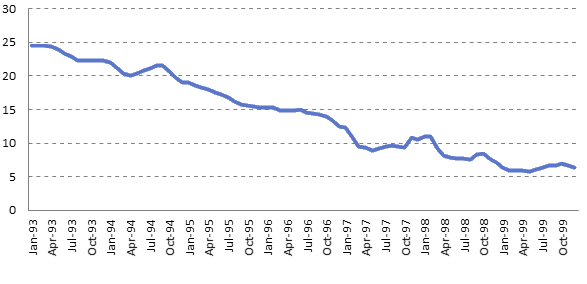

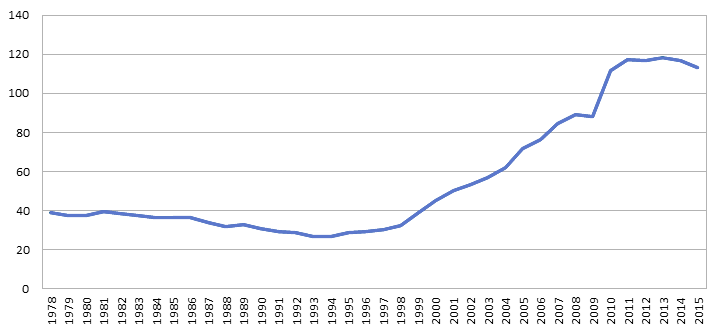

In Greece, the absence of currency risk since the adoption of the euro coupled with the establishment of convergence criteria led to an inflow of funds, driving down interest rates as investors required a lower risk premium for holding Greek debt, public or private. This pattern is illustrated in Exhibit 4, which shows the dramatic transformation in Greek bond yields in the run-up to the country joining the Eurozone in 2001. Bond yields slumped from 24% in early 1993 to around 6% by late 1999.

Exhibit 4: Nominal Greek Government Debt Yield, 1993–1999

Source: ECB Statistical Data Warehouse. Scale is measured in percentage terms.

Yield spreads to German bonds slumped over the same period—from 17% to well below 2%, which amounts to a remarkable change in investor perceptions of risk and return prospects. So, interest rate convergence had largely taken place before Greece even joined the Eurozone.

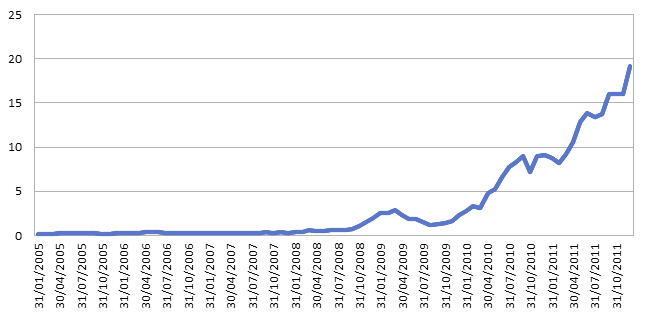

Low interest rates encouraged a boom in private-sector consumption. Exhibit 5 highlights the surge in lending to the private sector brought about by the slack monetary policy and resulting booming economy with strong inward investment.

Exhibit 5: Surge in Credit to the Private Sector, 1978–2015

Source: World Bank. Lending to the private sector is shown as a percentage of GDP.

Private-sector lending had been falling through the 1980s, a period associated with strong credit growth in many developed countries because of financial and economic liberalization. Although private-sector lending started to recover in the mid-1990s, it boomed really only from the late 1990s and throughout the 2000s—under the influence of the euro and as a result of Greece’s attempts to converge to the Eurozone membership criteria.

Ironically, as Exhibit 6 shows, in the run-up to the crisis, Greece was one of the developed world’s fastest growing economies. The combination of low interest rates, investors playing the convergence theme, and strong inward investment brought about an economic boom. Real GDP growth averaged nearly 4%, a healthy pace of growth, in the 10 years up to and including 2007. During that decade, the Greek economy grew nearly 50% in real terms, which is no mean feat. This brisk pace of growth was ushered in by easy access to credit, sustained high public spending (particularly on infrastructural projects), strong wage growth, high foreign direct investment, and general business confidence following Greece’s adhesion to the euro in 2001.

Exhibit 6: Greek Real GDP Growth Rates, 1996–2016

Source: OECD

Surging Government Spending Contributes to Unsustainability of the Boom

The Greek government was keen to encourage a strong economy—at least in terms of growth rates—to woo investors and, for political purposes, to bring about convergence to the high standards of living enjoyed by the most developed of the Eurozone’s countries, such as France, Germany, and the Netherlands. Growth at this pace was unsustainable, however; it was more akin to a binge, particularly in respect to credit growth, wage growth, and the big increases in public spending. Rather than creating the conditions for sustainable growth, the government was encouraging a bubble to develop.

As Exhibit 7 shows, between 2006 and 2009, government spending in Greece rose from 45% to 54% of GDP, despite the strong growth of the Greek economy at an annual 4% pace in the earlier part of the period. The failure of government revenues as a percentage of GDP to improve was troubling. Normally, in a strong cyclical upswing with booming credit demand and strong wage growth, government revenues as a percentage of GDP increase because of the boost to incomes and profits and, therefore, tax revenues. That this was not happening should have served as a warning sign to investors of the possibility of widespread fraud and tax evasion.

Exhibit 7: Greek Government Revenues and Expenditures as a Percentage of GDP, 2002–2016

Source: European Commission, Eurostat.

Only part of the sharp jump in the ratio of government spending to GDP can be explained by falling GDP. Nominal GDP was growing up to and including 2008; 2009 was the first year of declining nominal GDP. In 2010, both nominal GDP and public spending fell in absolute terms, leading to the first fall in the ratio of government spending to GDP.

At this time, the Greek government was concerned about economic equity and social cohesion and wanted to increase public spending selectively in such areas as pensions and salaries of public-sector employees. Revenue was held back by planned reductions in income taxes, especially on middle-income earners, although part of the loss of revenues was clawed back from increases in excise duties. Finally, the corporate tax rate was planned to be reduced from 35% in 2004 to 25% in 2007.

Substantial Government Data Revisions Prompt Sharp Increases in Spreads

As the global financial crisis set in during autumn 2008 with the collapse of Lehman Brothers, perception of risk increased and lenders required more remuneration for taking on the debt of peripheral Eurozone countries. So, Greece’s interest rate spreads widened relative to core Eurozone countries and interest payments on government debt began increasing.

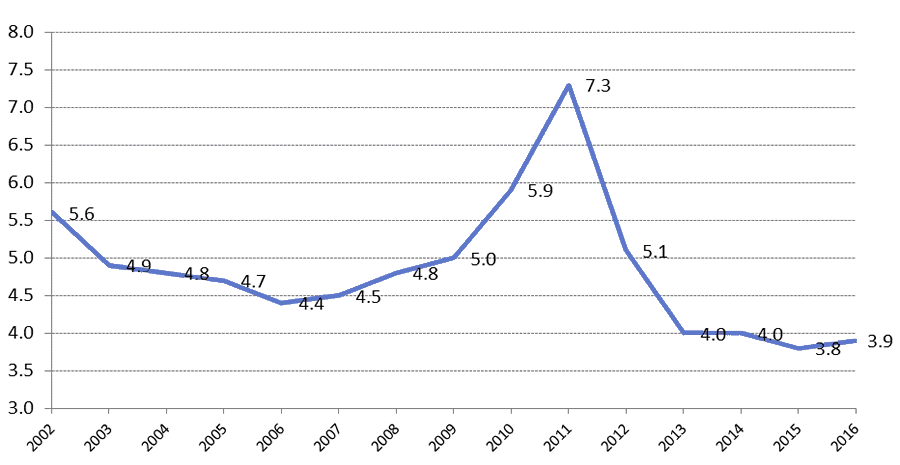

The Greek crisis was brought about more by events in Greece, however, than changes in risk perception by international investors. In autumn 2009, a year after the collapse of Lehman Brothers, the Greek government announced substantial upward revisions in the government budget deficit, prompting a flight of investors from Greek government debt and a gradual increase in credit spreads back to the dizzy levels associated with the period well before Greece joined the Eurozone.

In October 2009, the newly elected Greek government, led by the center-left PASOK, revealed that the 2008 government budget deficit was 7.7% of GDP, an upward revision from an earlier 5.0% filing. Even more significantly, the estimate for the 2009 budget deficit was revised from a forecast of 3.7% of GDP made earlier in the spring to a startling 12.5% of GDP, nearly 9 percentage points more. As a result, Fitch Ratings downgraded Greece’s credit rating to A–, the first time in a decade that the country’s debt was rated less than A. Ironically, the final 2009 budget deficit was even worse than the initial dramatically revised estimate—namely, 15.2% of GDP, illustrated in Exhibit 2. The financial impact of these revisions was striking. Exhibit 8 highlights the huge increase in credit spreads between Greek and German government debt.

Exhibit 8: Greek 10-Year Bond Spreads vs. German Bonds, 2005–2011

Source: ECB Statistical Data Warehouse. Scale measured in percentage terms.

From under 200 basis points at the time of the announcement of the budget deficit revisions in October 2009, spreads widened to 900 basis points a year later. Then, as the full implications hit home with investors two years later, the spread hit 1,600 basis points. The movement was underpinned by an overall strong aversion to peripheral Eurozone debt by investors.

A revision on this scale is extremely rare, but it had happened on several occasions with Greek debt, signaling to investors the poor quality and unreliability of statistics published by the Greek government. According to a report by the European Commission, the extent of the revisions was a result of incorrect data, failure to observe accounting rules, poor bookkeeping, and a lack of accountability and cooperation among different government bodies.

Greece has defaulted on its external sovereign debt obligations several times in the past 200 years. Five defaults occurred between 1826 and 1932. The first episode occurred in the early days of Greece’s war of independence, and the last default was during the Great Depression in the early 1930s. The combined length of period during which Greece was in default in the modern era totaled 90 years, or approximately 50% of the total period that the country has been independent.

The significant revisions served as a further wake-up call for investors in late 2009, just when there were signs that the worst had passed for the rest of the world and the global economy was poised to enter a recovery. Greece was thus out of sync with the rest of the global economy; its financial crisis was just beginning when signs of economic recovery were visible in major economies around the world.

Moreover, Greece concealed the true amount of its budget deficit as well as its sovereign debt outstanding, illustrated in Exhibit 1, by use of cross-currency swaps. The Greek government concocted a plan with investment bank Goldman Sachs in early 2002 for government debt issued in yen and US dollars to be swapped for euro debt for a certain time and then converted back into the original currencies at a later date. The catch was that the swap was performed at a fictional exchange rate unrelated to spot or future rates, which hid the true extent of the debt obligation. This tactic paved the way for Greece to sell more bonds without the alarming nature of the situation becoming too apparent to investors. By this cunning ploy, some 2% of Greece’s debt magically disappeared from its accounts.

It is a bit odd that the market “discovered” the Greek government’s subterfuge in 2009 because ample evidence revealed that the government had been misleading investors all along. In November 2004, well before the onslaught of any of the financial crises, Eurostat, the Directorate-General of the European Commission charged with keeping European Commission statistics and determining whether deficit targets had been met, noted that the Greek budget deficit and government debt had been misreported on no less than 11 occasions since 2000. Then, between 2005 and 2009, Eurostat issued further concerns about the quality of Greek data on five separate occasions.[1]

An example of the warnings is embodied in the following excerpt from a Eurostat Report on the Revision of Greek Deficit and Debt Figures published on 22 November 2004:

Recently, the Greek budgetary statistics have undergone a very large revision. The government deficit for 2003, which was initially reported at 1.7% of GDP, stood at 4.6% of GDP after the September 2004 notification. The deficits notified to the Commission for 2000, 2001 and 2002 were also revised upwards by more than 2 percentage points of GDP. Such substantial increases resulted from earlier actions undertaken by Eurostat as well as initiative taken by the incoming Greek government in spring 2004 to launch a thorough fiscal audit.

Revisions in statistics, and in particular in government deficit data, are not unusual. After the publication of the first outcomes in March by the national statistical institutes, data are often revised because new information becomes available, or because errors are detected. However, the recent revision of the Greek budgetary data is exceptional. Figures for 2003 were revised by almost 3 percentage points of GDP. The government debt figures were also significantly revised (by more than 7 percentage points).

In any case, few investors were prepared to bet that Greece would not be a successful member of the Eurozone, and they failed to imagine that the euro would be a major contributing factor in the ensuing Greek financial crisis. After all, the political commitment of the Greek government and people to the European project was total. (There had already been suggestions that manipulation of its financial statistics had enabled Greece to prematurely join the Eurozone right from the launch of the euro in 2001.)

As Exhibit 9 shows, interest payments on government debt soared as interest spreads widened when the financial crisis took hold—and when they were calculated on the significantly increased amounts of government debt. The increase in interest payments further increased the budget deficit, so there was a risk that Greece would enter a vicious downward spiral of higher debt levels leading to higher interest rates leading to increases in the budget deficit.

Exhibit 9: Greek Government Debt Interest Payments as a Percentage of GDP, 2002–2016

Source: European Commission, Eurostat.

Credit-Rating Downgrades Prompt Bailouts

In December 2009, credit-rating agency Fitch downgraded Greece’s credit ratings. Moody’s Investors Service and Standard & Poor’s followed suit. The Greek government responded by introducing, early in 2010, the first of a series of austerity measures. They involved a public-sector pay freeze and even pay cuts for some civil servants, a freeze on state pensions, coupled with an increase in the standard VAT from 19% to 21%, and increases in excise duties on fuel, alcohol, cigarettes, and luxury goods. The standard VAT rate was increased again later in 2010, to 23%.

The crisis really took hold of Greece and other peripheral Eurozone nations in 2010, well after the immediate effects of the global financial crisis were felt. The crisis in Greece was the result of a loss of investor confidence in the Greek economy and government administration plus a heightened perception of risk. Although Greek government bond issues in early 2010 were readily taken up by investors, it was at the cost of increasing interest rates, as shown in Exhibit 8. The increase was dramatic in scale: from a 300 basis point yield premium in late January 2010, Greek 10-year government debt shot up to a 1,000 basis point yield premium by late April 2010, just three months later.

In April 2010, the credit-rating agencies further downgraded Greek debt, signaling an elevated risk of a sovereign default. Fitch downgraded Greek government debt from BBB+ to BBB–, the lowest investment-grade rating. Standard & Poor’s downgraded its rating by two notches to BB+, the highest junk-level rating. Moody’s lowered its rating by four notches to A3, still investment grade.

The Greek prime minister at the time, George Papandreou, formally requested a bailout. Before any default could take place, in early May 2010, the European Commission, the ECB, and the International Monetary Fund (colloquially referred to as the “European troika”) agreed to bail out Greece with a EUR110 billion (USD146 billion) loan for three years. The loan was granted under conditions that Greece would implement a wide-ranging agenda of reforms—notably, austerity measures, structural reforms (including action against tax evasion), and privatization of state-owned assets. This initial intervention was subsequently referred to as the first Greek bailout.

Just days after the bailout was agreed to, the Greek government announced its third austerity package, involving spending cuts and tax increases amounting to EUR30 billion over the next three years. This EUR10 billion of annual belt tightening amounted to around 4.4% of annual GDP in 2010, each year for three years, which is considerable.

Greece’s rescue was met with strong public resistance, particularly from the labor unions, who organized mass demonstrations. Public opinion was also hostile to the stringent terms. Serious rioting in the streets led to deaths. A 48-hour national strike was called.

The situation was more than an economic crisis; it became a humanitarian crisis. The Greek state was unable financially to support the most vulnerable people in society. The austerity measures squeezed the incomes of the poorest and created hikes in utility bills, lower state pensions and civil service salaries, and higher taxes and duties.

The first bailout in May 2010 was followed by two more, —in February 2012 and July 2015. In 2011, Greece’s creditors agreed to take a large haircut on their debt of 53.5% of the face value (up from a previous maximum of 50%) to avoid a disorderly default by Greece on its debt.

Greece had not had access to the capital markets since 2010 to raise funds. The collapse of real GDP by 9.2% in 2011, shown in Exhibit 6, combined with the slow pace of structural reforms meant that Greece was incapable of facing up to its debt burden. So, the second bailout, slightly larger than the first, was agreed to. It was to be paid in 2014 and included the funds for bank recapitalization to the tune of EUR48 billion.

Some signs of stabilization appeared in 2014. Unemployment peaked the previous year, and the pace of contraction in real GDP had lessened in each successive year since 2011. There were predictions at this time that GDP growth would be positive in 2014. As Exhibit 10 shows, Greece attained a primary budget surplus (the budget deficit without the associated interest payments) in 2013.

Exhibit 10: Greek Government Budget Deficit as a Percentage of GDP, 2002–2016

Source: European Commission, Eurostat. The primary budget deficit excludes interest payments on debt.

These signs were a boost to investors as well as the Greek government. In April 2014, Greece was able to return to the capital markets to raise funds and successfully sold EUR3 billion of five-year bonds in an issue yielding 4.95% that was heavily oversubscribed. Fitch even upgraded Greece’s debt from B– to B in May 2014.

Despite the apparent improvement in Greece’s situation, however, a quick resolution to the crisis was not to be.

In 2012, GDP was 20% lower in real terms than it had been in 2009, just three short years before, and the fall in real GDP would reach 26% by 2013, relative to 2008, an unprecedented drop for a social market economy in a democratic western European state. The extent of the austerity measures exacerbated the impact of the recession, and between 2009 and 2015, the unemployment rate trebled. The Greek debt crisis amounted to a national emergency well beyond the proportions anyone could have imagined.

According to Eurostat, 44% of Greeks lived below the poverty line in 2014. In 2015, the OECD calculated that 20% of the Greek population lacked the funds to meet their daily food requirements. Soup kitchens doled out free food to the long-term unemployed, homeless, and poverty stricken. Between 2010 and 2012, suicide rates jumped by one-third. Around half a million Greeks, nearly 5% of the population, have left the country since the crisis began.

The shirking of responsibility by the Greek government after the July 2015 referendum (despite earlier tough measures to correct the economy), chronic economic uncertainty, and the government’s inability to face reality lengthened and deepened the crisis. Investors came to believe that the problems were insurmountable, and investor trust in the Greek government was seriously undermined as bailouts that were intended to be final were succeeded by further debt relief.

[1]Unfortunately for investors, Eurostat, did not register financial derivatives as debt, so it failed to reveal the true amount of Greek financial liabilities.

Conclusion

Government policy encouraging a strong but inflationary boom in the run-up to Greece joining the Eurozone, poor financial management, low accountability, excessive public spending, and massive tax fraud—all played a part in bringing about the Greek sovereign debt crisis. Greece’s membership in the Eurozone provided an additional shackle that severely restricted the country’s options for a policy response—for example, a currency devaluation. A devaluation, however, would have produced other problems, such as even higher sovereign debt levels and thus a longer repayment schedule.

Investors were understandably panicked by events in Greece because they had no frame of reference to fall back on. Even though Greece had defaulted on its debt several times in the previous 200 years, the 2009 crisis was the first time such a large-scale and prolonged crisis had occurred. With incomplete information because of the Greek government’s deceit and history of substantial revisions to the official economic data, investors understandably believed they were navigating in Greek securities markets without a compass. Therefore, even a rough gauge was impossible of just how high a premium Greek market interest rates ought to trade to compensate for the higher risk of default.

A number of red flags emerging in the run-up to the crisis ought to have forewarned investors of the looming crisis: unsustainable debt levels, lax monetary policy with easy access to credit, massive tax evasion, surging government spending with government tax revenues flat as a share of GDP despite a strongly-growing economy, and the Greek government’s poor track record in providing reliable and honest economic data.

Only the luckiest, as opposed to the most highly skilled investors, would have been able to judge the turning point, at some stage in the middle of the current decade, when investor confidence had bottomed, interest rates had peaked, the economy would start growing again, and unemployment would fall. In this type of fluid situation and volatile markets, timing and luck play a greater part in generating investment returns than does skill.